media-travel.ru

Overview

How Can I Add Money To Chime Card

Yes, You can load Chime card at walgreens. Customers can handover their cash and Chime debit card to the cashier to deposit in that card. Once. Once you enroll in direct deposit either in the mobile app or at media-travel.ru, you can get your money up to two days ahead of schedule. Chime makes your funds. No physical chime card needed to deposit! Open your Chime app and go to the Move Money page. Tap Deposit Cash. It's easy to transfer money online between Wells Fargo accounts, to another person, or to another financial institution. **If you choose to deposit cash using a Chime card, you must swipe your Credit Builder Card or Debit Card to deposit cash into your Chime Account. Our cash. Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Log in to your Chime mobile app. Select the Pay Anyone tab. Search for your friend's name or $ChimeSign, or enter the email or phone number of someone who isn't. Log in to your Chime mobile app. Select the Pay Anyone tab. Search for your friend's name or $ChimeSign, or enter the email or phone number of someone who isn't. Yes, You can load Chime card at walgreens. Customers can handover their cash and Chime debit card to the cashier to deposit in that card. Once. Once you enroll in direct deposit either in the mobile app or at media-travel.ru, you can get your money up to two days ahead of schedule. Chime makes your funds. No physical chime card needed to deposit! Open your Chime app and go to the Move Money page. Tap Deposit Cash. It's easy to transfer money online between Wells Fargo accounts, to another person, or to another financial institution. **If you choose to deposit cash using a Chime card, you must swipe your Credit Builder Card or Debit Card to deposit cash into your Chime Account. Our cash. Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Log in to your Chime mobile app. Select the Pay Anyone tab. Search for your friend's name or $ChimeSign, or enter the email or phone number of someone who isn't. Log in to your Chime mobile app. Select the Pay Anyone tab. Search for your friend's name or $ChimeSign, or enter the email or phone number of someone who isn't.

Direct deposit. · Bank transfer initiated through the Chime mobile app or website. · Bank transfers initiated from an external account. · Debit transactions. · Cash. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Use the Card everywhere Visa® Debit or Debit Mastercard® are accepted, plus get cash back at the register with PIN debit purchases where available. Send money. On the Home screen, tap Pay Anyone. · Tap either Request or Pay. · Search a friend by name or $ChimeSign, or type in the email or phone number of someone not on. After going into the store, go to the MoneyCenter counter or the customer service desk and ask the cashier to load the amount onto your Chime card. Simply ask the cashier to make a deposit to your Chime account at the register. You can make up to 3 deposits every 24 hours. You can deposit a maximum of. You can deposit cash into your Chime account at retailers like Wal-Mart, 7-Eleven, Walgreens, CVS, Dollar General, etc) (How do I deposit cash in my Chime. There are multiple ways to transfer money into your Credit Builder Secured Deposit Account. Deposit cash Transfer funds from your. Choose whether to pay with your credit3/debit card or with your bank account. Confirm, send and track your transfer. Now your money. Cash deposits to a Chime Checking Account are funds transfers made by third parties (who may impose their own fees or limits) and are FDIC-insured up to. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. Method 3: Use Your Chime Debit Card · Open Cash App and click “Banking.” · Select “Add Debit Card” and enter your Chime details. · Confirm the link between your. You can deposit cash at over 90, retail locations such as Walmart, 7-Eleven, Walgreens, Dollar General, Family Dollar, CVS, Rite Aid, and many others. You. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. Make an Automated Clearing House (ACH) transfer through online banking or by visiting a branch. Our member service reps are also available by phone. Transfer. Chime transfer specifics: Use the Chime website or app, input your debit card details, specify the amount, verify, and complete the transfer to move funds. the more button, then tap Card Details the card details button. On iPad: Open the Settings app, tap Wallet & Apple Pay. However, a limitation for some may be that you cannot deposit money into your account with a wire transfer. Try Chime ❯. or compare travel cards. Key Facts.

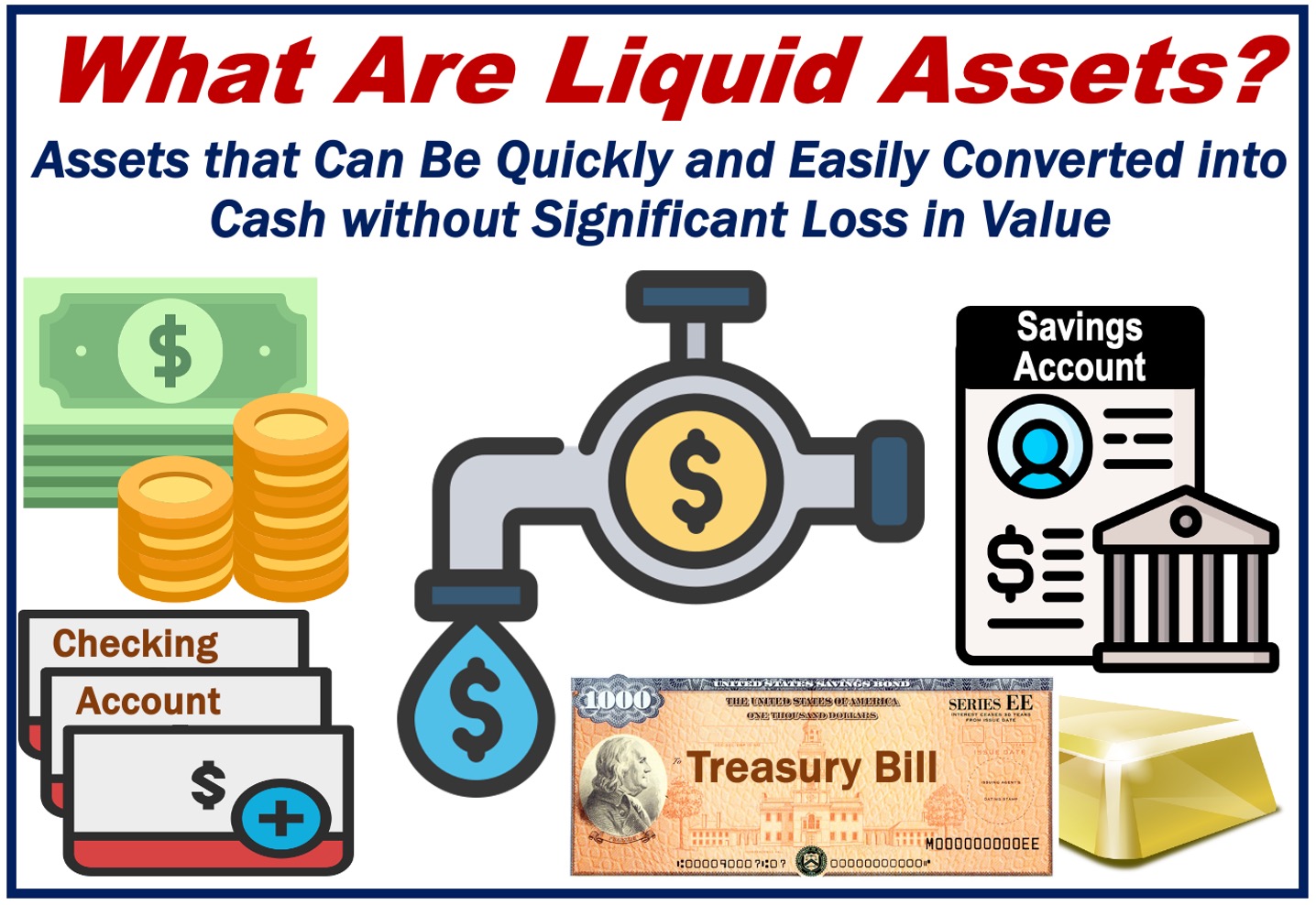

Meaning Of Liquid Assets

A liquid asset is something that you own that can be easily converted into cash and that too in a short amount of time (less than 90 days). Assets that can be. Liquid Assets: Assets easily converted to cash such as savings and checking accounts, stocks, bonds, certificates of deposit, retirement accounts, and money. Liquid assets refer to cash on hand, cash on bank deposit, and assets that can be quickly and easily converted to cash. When calculating liquid net worth, you typically do not include retirement accounts nor real estate. Liquid net worth's meaning involves assets you can quickly. However, liquid assets also include checking accounts, saving accounts, money market accounts, certificates of deposit (CDs), mutual funds, bonds, and stocks. A total liquid asset is a variant of liquid asset. There is a specific formula by which total liquid asset is calculated. Any asset that can be converted to. A liquid asset is cash on hand or an asset other than cash that can be quickly converted into cash at a reasonable price. Liquid assets include cash equivalents—these are short-term investments that are low risk and low return. You may choose to keep a portion of your business's. What is Liquid Asset. Definition: An asset is said to be liquid if it is easy to sell or convert into cash without any loss in its value. By definition, bank. A liquid asset is something that you own that can be easily converted into cash and that too in a short amount of time (less than 90 days). Assets that can be. Liquid Assets: Assets easily converted to cash such as savings and checking accounts, stocks, bonds, certificates of deposit, retirement accounts, and money. Liquid assets refer to cash on hand, cash on bank deposit, and assets that can be quickly and easily converted to cash. When calculating liquid net worth, you typically do not include retirement accounts nor real estate. Liquid net worth's meaning involves assets you can quickly. However, liquid assets also include checking accounts, saving accounts, money market accounts, certificates of deposit (CDs), mutual funds, bonds, and stocks. A total liquid asset is a variant of liquid asset. There is a specific formula by which total liquid asset is calculated. Any asset that can be converted to. A liquid asset is cash on hand or an asset other than cash that can be quickly converted into cash at a reasonable price. Liquid assets include cash equivalents—these are short-term investments that are low risk and low return. You may choose to keep a portion of your business's. What is Liquid Asset. Definition: An asset is said to be liquid if it is easy to sell or convert into cash without any loss in its value. By definition, bank.

Any asset you own that can be easily liquidated or converted into cash without it losing much value is a liquid asset. Liquidity is essentially a term used to. At its core, liquidity asset refers to an asset that can be easily cashed out without incurring significant losses. The primary characteristic of liquid assets. Liquid asset secured financing is a flexible line of credit secured by eligible assets in one or more of your investment accounts. “In essence, your investment. Liquid assets are cash, or assets that can be easily and quickly converted Glossary definition. What are liquid assets? Liquid assets are cash, or. cash, or an investment or something valuable that can be easily sold: She has very few liquid assets as most of her wealth is tied up in stocks and shares. There are various criteria an asset meets to be considered liquid capital. For example, liquid assets exist within an established market, which allows. Of the current assets considered highly liquid, cash ranks at the top of the list. Other kinds of assets, such as marketable securities, accounts receivable. “An asset is said to be liquid if it is easy to sell or convert into cash without any loss in its value.” Image. Liquid asset secured financing is a flexible line of credit secured by eligible assets in one or more of your investment accounts. “In essence, your investment. A liquid asset is therefore an asset that can be sold quickly without significant loss of value. Bank account balances are liquid assets. Most stocks are also. Liquid assets are defined as assets that can be easily converted into cash. Money owed to your company and inventory are examples of liquid assets in. Liquid Assets: It can easily be converted into cash within a short amount of time. Here is a list of Liquid Assets: Cash in Hand, Cash in Bank. Net liquid assets is a term used to define the immediate liquidity position of a company. It is calculated as the difference between liquid assets and current. assets in the form of cash (or easily convertible into cash). The term “net liquid assets” simply refers to the total sum of a business's cash and other liquid assets, minus its current liabilities. By subtracting these. Liquid assets include cash and due from banks, trading securities and at fair value through income, loans and advances to banks, reverse repos and cash. However, liquid assets also include checking accounts, saving accounts, money market accounts, certificates of deposit (CDs), mutual funds, bonds, and stocks. Liquid assets are those assets which can be easily converted into cash. For example, cash, savings account, investments, exchange-traded funds. The formula for liquid assets is pretty simple and straightforward. You should add all your assets that are considered liquid, including your transferable. There are various criteria an asset meets to be considered liquid capital. For example, liquid assets exist within an established market, which allows.

How To File A Complaint Against Hr

If your employer has an internal complaint process, it's generally advisable to begin there. Start by reporting your concerns to your immediate supervisor or. In many states, federal employees have 45 days to reach out to an EEOC agent, other workers have days to file with the EEOC. When you file a complaint, you'. In a well-run organization, that complaint would be submitted to whoever the HR manager reports to: either the Director/Manager/Boss of your. Respondent - A person who is affiliated with the University against whom the Complainant has filed a Complaint. Office: media-travel.ru To complete the online EEO Complaint Form, follow this link, enter your name and email address, then "Beginning Signing". Complete all required fields. The most important step is to take action once the complaint has been received. Reach out to the employees involved and find out their side of the story. Find. A formal complaint may involve filing a grievance or a formal investigation through HR. complaint and following an initial consultation with the complainant. Our company takes all employee complaints—including those of discrimination, harassment, unethical conduct or safety violations, as serious matters. Put your complaint or complaints in writing— There is inherent risk of unlawful retaliation when making a formal complaint to an employer. Make sure to specify. If your employer has an internal complaint process, it's generally advisable to begin there. Start by reporting your concerns to your immediate supervisor or. In many states, federal employees have 45 days to reach out to an EEOC agent, other workers have days to file with the EEOC. When you file a complaint, you'. In a well-run organization, that complaint would be submitted to whoever the HR manager reports to: either the Director/Manager/Boss of your. Respondent - A person who is affiliated with the University against whom the Complainant has filed a Complaint. Office: media-travel.ru To complete the online EEO Complaint Form, follow this link, enter your name and email address, then "Beginning Signing". Complete all required fields. The most important step is to take action once the complaint has been received. Reach out to the employees involved and find out their side of the story. Find. A formal complaint may involve filing a grievance or a formal investigation through HR. complaint and following an initial consultation with the complainant. Our company takes all employee complaints—including those of discrimination, harassment, unethical conduct or safety violations, as serious matters. Put your complaint or complaints in writing— There is inherent risk of unlawful retaliation when making a formal complaint to an employer. Make sure to specify.

Complaints under this policy must be filed within one hundred and fifty () calendar days from the date upon which the alleged violation occurred. If an. Meeting: Within 5 working days from receipt of the written grievance, the department head or their representative will schedule a meeting with the staff member. Meeting: Within 5 working days from receipt of the written grievance, the department head or their representative will schedule a meeting with the staff member. HR Information Systems · HR Forms · HR Support Systems. Internal Complaint Processes. Grievance Process Icon. The George Washington University is an Equal. If being alone with your boss is safe, you can try talking to him before filing a complaint. It's possible your boss isn't aware of how offensive or. If it is appropriate for resolution through the informal complaint procedure as stated above, HR will schedule a meeting with the college or unit head to. Time Limits for Filing a Charge · Online - Use the EEOC Public Portal to Submit an Inquiry, Schedule an Appointment, and File a Charge · In Person at an EEOC. Complaints under this policy must be filed within one hundred and fifty () calendar days from the date upon which the alleged violation occurred. If an. When you receive notice about the HR officer's negligence, note the officer's role in the circumstances, his rank in the HR department and the organizational. Your complaint should be in writing. When you write your complaint, you should follow any procedures outlined in your employee handbook. If you do not have an. If being alone with your boss is safe, you can try talking to him before filing a complaint. It's possible your boss isn't aware of how offensive or. File a harassment charge with the EEOC if HR won't investigate. The Equal Employment Opportunity Commission (EEOC) investigates claims of workplace harassment. When you receive notice about the HR officer's negligence, note the officer's role in the circumstances, his rank in the HR department and the organizational. If you are ever uncertain about how to handle a situation, please contact Human Resources. We are here to help you! [email protected] · · Jackson. An HR's Guide to Dealing with Employee Complaints · Form An Internal Committee · Maintain Confidentiality · Document The Complaint · Investigate · Communicate · The. HR professionals should acknowledge receipt of the complaint, conduct a thorough investigation, take appropriate action, and follow up with the employee to. Complainants are encouraged to use the Department of Administration's complaint form found at media-travel.ru Montana state government prohibits. Dealing with a grievance will cost you time and money and be extremely stressful for both the employee and you as the employer, so best to avoid it. It will. State HR Professionals · State Retirees. Main Content; media-travel.ru · About Us · Contact with the appropriate grievance form above. Statutory Appeals. Follow the.

Performance Stock Options

Performance shares are performance-contingent pay denominated in common stock and earned over a performance period if certain performance goals are attained. These are non-equity-based long-term grants that pay out in cash. The grantee will receive a cash payout after the vesting period. Performance cash units. These. In the limited number of instances that we observe performance options, the performance condition is either a stock price hurdle or a financial goal, such as. Awards of share options whose exercise price is determined solely by reference to a future share price generally would not provide a sufficient basis to. Types of Awards, Payments, and Limitations. Awards shall consist of Stock Options, SARs, Restricted. Stock, Restricted Stock Units, Performance Shares. Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the. The main goal in granting stock options is, of course, to tie pay to performance—to ensure that executives profit when their companies prosper and suffer when. It depends on the stage of the company and the particular job you are getting as well as your level of experience. You can use this Equity. Performance or Market Condition—An alternative to time-based vesting is vesting based upon the satisfaction of a performance condition (e.g., achievement of a. Performance shares are performance-contingent pay denominated in common stock and earned over a performance period if certain performance goals are attained. These are non-equity-based long-term grants that pay out in cash. The grantee will receive a cash payout after the vesting period. Performance cash units. These. In the limited number of instances that we observe performance options, the performance condition is either a stock price hurdle or a financial goal, such as. Awards of share options whose exercise price is determined solely by reference to a future share price generally would not provide a sufficient basis to. Types of Awards, Payments, and Limitations. Awards shall consist of Stock Options, SARs, Restricted. Stock, Restricted Stock Units, Performance Shares. Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the. The main goal in granting stock options is, of course, to tie pay to performance—to ensure that executives profit when their companies prosper and suffer when. It depends on the stage of the company and the particular job you are getting as well as your level of experience. You can use this Equity. Performance or Market Condition—An alternative to time-based vesting is vesting based upon the satisfaction of a performance condition (e.g., achievement of a.

As companies take a portfolio approach to stock compensation, you may be granted performance shares, which you receive only upon the achievement of specified. Incentive stock options (ISOs) in which the employee is able to defer taxation until the shares bought with the option are sold. The company does not receive a. They show that CEO pay has become much more sensitive to corporate performance than it once was. And they credit stock options for this change. Unlike restricted and performance awards, restricted and performance stock units do not represent actual ownership interests in the underlying company shares. Performance shares both make investors happy and create a stronger link between pay and performance. While stock options and restricted stock remain important. Performance shares, unlike standard stock-option schemes, provide managers with company equity or stock options in exchange for fulfilling goals. Definition of. Stock options are the most common type of equity compensation awarded to employees. Like the types of stock options you see traded on exchanges, employee stock. A performance award is a grant of company shares or units in which the recipient's rights in the shares or units are contingent on the achievement of pre-. A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the “exercise price” or “strike price,” for a fixed. Long term incentive plans (LTIPs or LTIP Units); Restricted stock units (RSUs) and restricted stock ; Financial reporting, principally under ASC (formerly. Rather than granting shares of stock directly, the company gives options on the stock instead. performance targets. Stock appreciation rights (SARs): SARs. Many executive compensation observers have suggested that performance options — standard stock options with one or more additional performance conditions. This Agreement evidences the grant of a nonqualified stock option (the “Option”) by FARO Technologies, Inc., a Florida corporation (the “Company”), to the. In the event of quarter to quarter decreases in revenues and or cash flow, the Performance Options shall not vest for that quarter but the unvested quarterly. Master equity compensation with our world-class platform. Ensure compliance, save time, and inspire your team for optimal performance. equity-compensation. Performance units are split into two categories. The first category of performance units is generally granted on a one-unit-to-one-share basis. These are most. Define Performance Stock Option (PSO) Grant. or “PSO” shall mean a grant of a performance stock option under the Plan that allows the Selected. Some of the more common modifications are a change in vesting conditions or a repricing of options. Modifications of performance or service conditions. Stock options now account for more than half of total CEO compensation in the largest US companies and about 30% of senior operating managers' pay. That means the employees must wait at least 6 months after they receive stock options or stock appreciation rights before they are able to exercise the right.

Background Check Do Not Contact Employer

But the employer cannot conduct background checks or use the information obtained in a manner that denies equal employment opportunity to anyone on a protected. Background checks may reveal previous employment, and the discovery that you omitted information from your work history can hurt your current chances of finding. Many do, yes. The background check is existential problem for most of the firms - because if you do not know what sort of people you are hiring. Criminal convictions or pleas will not automatically exclude a finalist from consideration for employment unless they are related to the position offered and. HR best practice: if possible, do not ask about criminal history until the tentative offer of employment has been made - that will lower the risk of. Employment Verification involves contacting past and/or current employers to verify information such as dates of employment, positions held, and eligibility for. A background check helps to verify your previous employers and that you have the relevant skills an employer wants. To check your credentials, a prospective. If you have not received a link, please contact your prospective employer or property management company. You can always visit media-travel.ru and click to. Yes. There's typically a box that says do not contact do these background checks pull your credit? i'm closing on my home loan in 3 days. For Deloitte, you. But the employer cannot conduct background checks or use the information obtained in a manner that denies equal employment opportunity to anyone on a protected. Background checks may reveal previous employment, and the discovery that you omitted information from your work history can hurt your current chances of finding. Many do, yes. The background check is existential problem for most of the firms - because if you do not know what sort of people you are hiring. Criminal convictions or pleas will not automatically exclude a finalist from consideration for employment unless they are related to the position offered and. HR best practice: if possible, do not ask about criminal history until the tentative offer of employment has been made - that will lower the risk of. Employment Verification involves contacting past and/or current employers to verify information such as dates of employment, positions held, and eligibility for. A background check helps to verify your previous employers and that you have the relevant skills an employer wants. To check your credentials, a prospective. If you have not received a link, please contact your prospective employer or property management company. You can always visit media-travel.ru and click to. Yes. There's typically a box that says do not contact do these background checks pull your credit? i'm closing on my home loan in 3 days. For Deloitte, you.

Arrests that did not lead to conviction and sealed or expunged conviction records do not need to be disclosed. Providing incomplete, inaccurate, or false. Federal law does not prohibit employers from conducting background checks before an offer of employment is made. State laws, however, may have restrictions. A: If a business or organization requests a background check on you, then we will send you an email that asks you to consent to the background screening. If you. The background check will verify employment and dates; it does not include a reference check of performance. If a candidate is not comfortable with an employer. Employers must get your written permission before running a background check from a background reporting company. You have the right to say no, but if you do. In other words, the employer can refuse to hire you – or even consider you for the position – if you don't consent to a reasonable request. Can an employer pull. What if I don't have a former employer's contact information? If you do not want your current employer contacted, you need to advise the Clearance Coordinator who contacts you regarding the completion of your SF If the candidate has requested that you not contact a certain reference on their application and still does not agree to you contacting a former employer now. An applicant may act out of fear and think it reflects poorly to not give a hiring manager permission. However, a job seeker might not want a. If you suspect the background check has been unable to verify dates of employment for a certain employer, contact the background check company and ask what you. You can obtain your own public records by contacting state and county courthouses in the jurisdictions where you've lived or may have records on file. Costs. For example, we may collect name and phone number for employment verification and school, degree earned and graduation date for an education verification. Why. This is now information that you can't “unsee” and you can not prove that this information did not influence your ultimate decision to either hire or not hire. If they do not correct the errors after your dispute or you have been harmed by their inaccurate reporting such as job loss and stress you may have a case and. Most recruiters and interviewers understand that job searches can be confidential and won't contact your current employer until they clear it with you first. So. No, employers cannot run background checks without obtaining permission first. If employers use "People Search Sites", like Spokeo. Verification of certain aspects of resume credentials and other information not included on resumes, such as civil litigation, negative media searches, and. Instead, most prospective employers will provide start and end dates of employment and job titles. Questions You Can Ask on a Reference Call. The best place to. What dings your record for one job might not have the same effect in a different job. Meaning that if you were convicted of a crime relevant to the job's.

Best Investments For Roth Ira

What kind of IRA best suits my needs? Traditional IRA or Roth IRA? · Traditional vs. Roth IRA comparison chart · You can set up an IRA with a: bank or other. Save for retirement with a tax-advantaged TIAA IRA. Choose from Traditional IRAs, Roth IRAs, rollovers & find the best IRA investments for your goals. Best investments for a Roth IRA · U.S. stock index funds · U.S. bond index funds · Global stock index funds · Dividend stock funds · REIT funds · Target-date. +MoreAll InvestingBest IRA AccountsBest Roth IRA AccountsBest Investing AppsBest Free Stock Trading PlatformsBest Robo-AdvisorsIndex FundsMutual FundsETFsBonds. Best investments for a Roth IRA · U.S. stock index funds · U.S. bond index funds · Global stock index funds · Dividend stock funds · REIT funds · Target-date. threshold – $ (filing single) or $ (filing joint) for – a Roth IRA may be appropriate for you. Contact PNC Investments to find out more. Best Roth IRA for Beginner Investors SoFi is a competitive, low-cost choice for those interested in opening a Roth IRA. SoFi Roth IRAs are eligible as self-. After opening up the right IRA for your needs, you can choose from a wide range of investment products, such as mutual funds, stocks, ETFs and bonds. When it's. Keep more of what you make: Any investment growth in a Roth is tax-free, with tax-free withdrawals in retirement Flexible access to your money. Need money in. What kind of IRA best suits my needs? Traditional IRA or Roth IRA? · Traditional vs. Roth IRA comparison chart · You can set up an IRA with a: bank or other. Save for retirement with a tax-advantaged TIAA IRA. Choose from Traditional IRAs, Roth IRAs, rollovers & find the best IRA investments for your goals. Best investments for a Roth IRA · U.S. stock index funds · U.S. bond index funds · Global stock index funds · Dividend stock funds · REIT funds · Target-date. +MoreAll InvestingBest IRA AccountsBest Roth IRA AccountsBest Investing AppsBest Free Stock Trading PlatformsBest Robo-AdvisorsIndex FundsMutual FundsETFsBonds. Best investments for a Roth IRA · U.S. stock index funds · U.S. bond index funds · Global stock index funds · Dividend stock funds · REIT funds · Target-date. threshold – $ (filing single) or $ (filing joint) for – a Roth IRA may be appropriate for you. Contact PNC Investments to find out more. Best Roth IRA for Beginner Investors SoFi is a competitive, low-cost choice for those interested in opening a Roth IRA. SoFi Roth IRAs are eligible as self-. After opening up the right IRA for your needs, you can choose from a wide range of investment products, such as mutual funds, stocks, ETFs and bonds. When it's. Keep more of what you make: Any investment growth in a Roth is tax-free, with tax-free withdrawals in retirement Flexible access to your money. Need money in.

Other investment options With a Vanguard Brokerage Account, you can also enjoy low commissions when you buy and sell: If you're also investing in a. Investments for your TIAA IRA. Need help? Speak with an IRA consultant. Regulation best interest. Form CRS · Learn more. FINRA BrokerCheck. Check the. Consider Vanguard Total Stock Market Index Fund (VTSAX) or Vanguard Target Retirement Funds for your Roth IRA. These low-cost index funds offer. 8 best Roth IRA investments for your retirement · 1. S&P index funds · 2. Dividend stock funds · 3. Value stock funds · 4. Nasdaq index funds · 5. REIT. The 10 best Roth IRAs · Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA. The 10 best Roth IRAs · Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA. Best of both worlds. If it makes sense in your scenario, you could Take advantage of tax contribution limits and open a Thrivent Mutual Funds IRA today. One way to beat inflation is to invest your money, which you can do through a Roth IRA. The hope when saving for retirement through any kind of retirement. Roth IRAs offer an opportunity to create tax-free income during retirement and are a good way to diversify your retirement income. Sit back & relax, or set out on new adventures. With the help of an IRA, you can afford to save for your dream retirement. · Choose Traditional or Roth IRAs. Why consider a Roth IRA? A Roth IRA can be a good savings option for those who expect to be in a higher tax bracket in the future, making tax-free withdrawals. As such, there are two primary reasons why a Roth IRA is a great starter investment for teens and young adults: Taxes and the power of compound growth. A. TD Ameritrade is our top choice for investors who want hands-on management of their Roth IRA. The brokerage offers a range of tools and resources for active. The Roth IRA offers many retiree benefits, with tax treatment being the most advantageous for account holders. Key Takeaways. Roth IRAs allow for tax-free. You have many investing options to choose from when opening a Roth IRA. We've outlined some of our top choices when it comes to selecting the best investments. Best Mutual Funds for Roth IRAs · Schwab Fundamental U.S. Large Company Index Fund (SFLNX) · Fidelity Growth Discovery Fund (FDSVX) · Calvert Core Bond Fund Class. Investment options: saving plans have limited static and dynamic portfolios, while Roth IRAs offer a broader set of investment options, including stocks. Yes, you can roll eligible Roth funds in or out (Roth IRA is not eligible) best for you. How is DCP Roth different from a Roth IRA? The main difference. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. You can contribute to a Roth IRA at any age if you have earned income (earnings from employment, including self-employment or alimony, not investment or rental.