media-travel.ru

Community

How Much Money Do I Need To Day Trade

How can a day trader earn more money? · Trade in foreign markets · Pursue education and certification · Research other methods of trading. Day traders get a wide variety of results that largely depend on the amount of capital they can risk, and their skill at managing that money. If you have a. For beginners, many financial advisors suggest starting with no more than 5% to 10% of your investable assets. Your age and financial goals also play a role. Astonishingly, a mere 3% turned a profit! These figures could potentially be more dismal, considering the study only took into account traders active for over. A general rule of thumb is to risk no more than 1% to 2% of your account on a single trade. With more trading capital, you can take on more positions while. So, what does that mean for the average investor? First, the U.S. stock market requires you to have a minimum of $25, in order to engage in day trading. Traders often want a return on investment (ROI) of 1% to 3% every day. Assuming a cautious 1% ROI, you'd need at least $50, of cash to earn. If the customer does not meet the margin call by the fifth business day, the day trading account will be restricted to trading only on a cash available. Over here, if you set up an account with $1,, most of these brokers will give you a minimum of four times leverage. That means you can day trade with $4, How can a day trader earn more money? · Trade in foreign markets · Pursue education and certification · Research other methods of trading. Day traders get a wide variety of results that largely depend on the amount of capital they can risk, and their skill at managing that money. If you have a. For beginners, many financial advisors suggest starting with no more than 5% to 10% of your investable assets. Your age and financial goals also play a role. Astonishingly, a mere 3% turned a profit! These figures could potentially be more dismal, considering the study only took into account traders active for over. A general rule of thumb is to risk no more than 1% to 2% of your account on a single trade. With more trading capital, you can take on more positions while. So, what does that mean for the average investor? First, the U.S. stock market requires you to have a minimum of $25, in order to engage in day trading. Traders often want a return on investment (ROI) of 1% to 3% every day. Assuming a cautious 1% ROI, you'd need at least $50, of cash to earn. If the customer does not meet the margin call by the fifth business day, the day trading account will be restricted to trading only on a cash available. Over here, if you set up an account with $1,, most of these brokers will give you a minimum of four times leverage. That means you can day trade with $4,

A realistic day trading income for successful traders should be around one to four percent per month; The majority of traders make huge losses - it is therefore. Try to make $ per week on a trading account of $5, That would be $ per month or 8% based on your capital. Per month!!! You might not achieve your. 25k is only needed for those in the US to day trade stocks to get around the PDT rule. I'd say you need around $ min and trade something that doesn't have. This means that day traders must have sufficient capital on top of the $25, to make a profit. Plus, day trading requires focus. It's not compatible with. You need a minimum of $25, equity to day trade a margin account because the Financial Industry Regulatory Authority (FINRA) mandates it. The regulatory body. To start day trading stocks, it's often recommended to have at least $25,, especially if you're in the U.S. and want to avoid the Pattern Day. 4% of people were able to make a living with adequate capital, access to mentors, and practicing multiple hours every day during the week. · Roughly 10% to 15%. Minimum equity requirement: As a pattern day trader, you are required to hold a minimum of $25, in your account at all times. This can be a mix of cash and. While stocks are the most common, traders in Canada have the choice of trading US stocks, Exchange-Traded Funds (ETFs), and options. There is no minimum. Another question traders may be asking is: 'how much capital do you need?' The one requirement of day trading from home is capital. Roll back the dice a few. If your account is flagged for PDT, you're required to have a portfolio value of at least $25, to continue day trading. Your portfolio value is the sum of. That means you should risk $ at most to make $, or $ to make $ Unfortunately, many beginner traders find themselves in the pattern of taking. “Becoming a day trader is something that a lot of people see as an easy way to make money, where you don't need much experience — just click a few buttons and. How much money is needed to start day trading? The amount of capital required for day trading varies based on individual strategies and risk tolerance. Most. Most of the retail brokers will let you open a trading account with as little as $ It is foolish to even think that you can make some reasonable money. For day traders in the U.S. the minimum trading account size required to day trade stocks is $25, If the total trading capital in the. In the United States, based on rules by the Financial Industry Regulatory Authority, people who make more than 3 day trades per 5-trading-day period are termed. How Much You Need to Retire · Planning Calculators · Complimentary Plan · Advice Schwab does not recommend the use of a day trading strategy. Examples. There are many confident online reports that a day trader can return profits of 10 percent each month, or no, wait, that's 18 percent per month or you get. How much does a Day Trader make? As of Aug 28, , the average annual pay for a Day Trader in the United States is $96, a year. Just in case you need a.

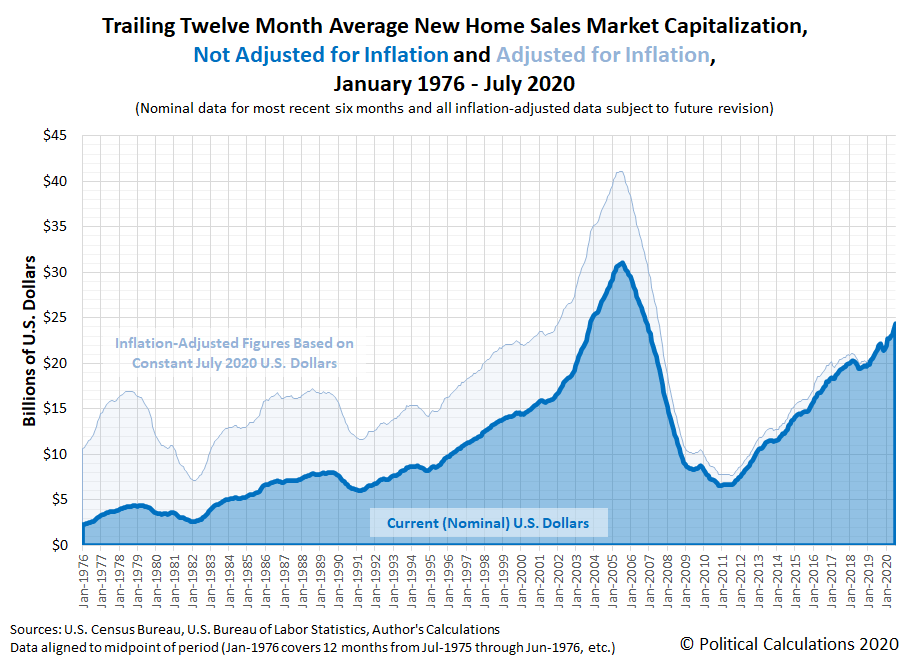

Housing Prices Recession

During economic recessions, house prices tend to go down. The reason is quite simple; personal income is one of the most significant factors driving home. What is the housing market like right now? In July , U.S. home prices were up % compared to last year, selling for a median price of. decline in housing prices, while housing prices have increased duri. housing prices fell during a US recession. The recession was. Many borrowers took out loans they couldn't otherwise afford, and when house prices declined soon after, they ended up defaulting on their mortgages. This led. Do House Prices Go Down in a Recession? Yes, home prices often decline during recessionary periods, but not universally across all housing. If an upcoming recession occurs, it will likely be due to trade policy, a geopolitical crisis, and/or stock market correction but NOT a housing slowdown. The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting. Home values tend to rise over time, but recessions and other disasters can lead to lower prices. · Following slumps, home values can increase in some areas of. How Much Do Canadian House Prices Fall, or Crash, In a Recession: 40 Years of Data Analyzed. · In the worst-case scenario, house prices may crash about During economic recessions, house prices tend to go down. The reason is quite simple; personal income is one of the most significant factors driving home. What is the housing market like right now? In July , U.S. home prices were up % compared to last year, selling for a median price of. decline in housing prices, while housing prices have increased duri. housing prices fell during a US recession. The recession was. Many borrowers took out loans they couldn't otherwise afford, and when house prices declined soon after, they ended up defaulting on their mortgages. This led. Do House Prices Go Down in a Recession? Yes, home prices often decline during recessionary periods, but not universally across all housing. If an upcoming recession occurs, it will likely be due to trade policy, a geopolitical crisis, and/or stock market correction but NOT a housing slowdown. The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting. Home values tend to rise over time, but recessions and other disasters can lead to lower prices. · Following slumps, home values can increase in some areas of. How Much Do Canadian House Prices Fall, or Crash, In a Recession: 40 Years of Data Analyzed. · In the worst-case scenario, house prices may crash about

Prices have risen nicely over the last few years, leading to over fifty percent of homes in the country having greater than 50% equity. But owners have not been. FAQs. When will the housing market crash? Actually, most industry experts do not expect it to. Housing economists point to five main reasons that the market. U.S. recession: Select a recession, End, Start U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales. While home prices escalated, the increase in buying power fueled by low interest rates led to a decrease in the home inventory available to buyers. Houses that. Rise and Fall of the Housing Market The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing. The property market will carry on regardless of whether you enter it or not, so it's far more important to look at your own personal circumstances. The crisis led to a severe economic recession, with millions losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series. Will the housing market crash if we go into a recession? Not necessarily. In fact, given the current unique housing market conditions, this is unlikely. “This. How Much Do House Prices in the UK Fall, or Crash, In a Recession: 50 Years of Data Analysed. · In the worst-case scenario, house prices may crash about 20%, in. The Second Oil Price Shock (–) - Real house prices were still falling despite low or even negative real mortgage interest rates. Then oil prices more. According to economic experts, home values will decline by %, which is the range by which property values often decline during recessions. Why. The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting. Housing affordability is at an all-time low and prices could easily start declining again. That said, demand is still relatively strong from trade-up buyers and. It will likely take a while before the inventory of available homes matches up with demand. Experts surveyed by Zillow predicted it'll be two years before. The U.S. “Housing Recession”. August 21, Economists often look to the housing market as an indicator of the health of the economy. As the COVID-. Recession arrived, home prices sank about 11%, sales activity plunged and the market stayed basically flat for 4 to 5 years. Still, even after the decline, home. The Bottom Line. Home prices will continue rising over the long term like they always have. The home you want is going to be more expensive a. U.S. recession: Select a recession, End, Start Tags. New Residential Sales Housing and Urban Development Sales Median Housing. Rise and Fall of the Housing Market The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing. View data of a benchmark of average single-family home prices in the U.S., calculated monthly based on changes in home prices over the prior three months.